Tax-loss harvesting is a planning strategy in which an investor proactively sells an investment at a loss, not for “market-timing” or portfolio rebalancing, but specifically for collecting a loss that is available in their portfolio. Ideally, the loss generated will offset a gain realized by the client over the previous three years. The client can then offset a realized gain on a tax return for one of the previous three years and may receive a refund on their next tax return.

However, this type of strategy must be carefully planned to avoid pitfalls. If a client sells an investment at a loss but doesn’t have a gain to offset it on their return, the strategy will fail. It will not generate any immediate tax savings.

Some ground rules

- The Canadian tax system allows the capital loss on the sale of an investment to be used to offset any capital gain realized during the tax year.

- Only non-registered investments can be used in a tax-loss harvesting strategy. This includes stocks, bonds, mutual funds and exchange-traded funds.

- A capital loss can be carried back up to three previous tax years. It can also be carried forward indefinitely in subsequent years.

- An investor or a person affiliated with the investor cannot buy back the same security within 30 days of the sale. In such a case, the capital gain resulting from the sale at a loss will be denied.

See our article on realizing capital loss: The superficial loss rules – Have you tripped the wire?

Generating tax alpha: two scenarios

However, you can go further than offsetting a client’s capital gain with a loss. Here are two specific situations that may allow a client/investor to generate tax alpha.

Scenario 1: Reinvest the tax savings that will be realized

You can generate tax alpha by selling an investment at a loss and investing the resulting tax savings.

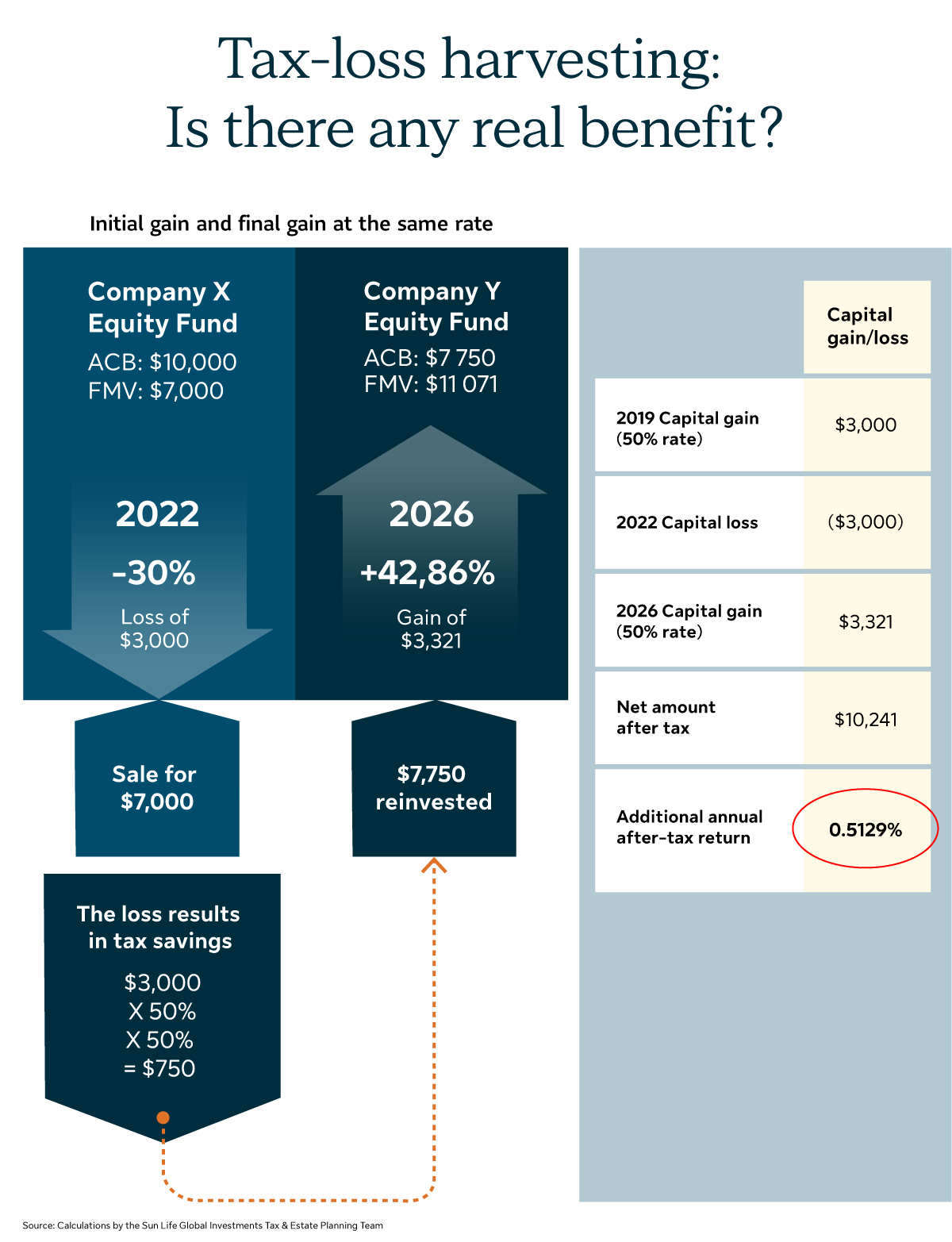

An investment purchased for $10,000 and sold at a loss for $7,000 will result in a tax savings of $750 if a 50% tax rate is used.

What happens if the client reinvests the $7,000 and the investment value then increases by $3,000? The investment will only regain the value originally invested once realized. The tax savings generated by the loss will only offset the tax payable on the capital gain.

However, what happens if you add the $750 in tax savings that will eventually be realized to the reinvested amount? The return on the amount of tax savings invested will provide tax alpha. This happens even though the Client will have to pay tax on the capital gain realized on the second investment purchased. The deferred capital loss will be eliminated. Tax alpha will be 51 basis points, for an amount of $11,071:

Detailed example: Imagine the scenario of an investor who holds a losing investment. It costs $10,000 and its fair market value (FMV) is now $7,000. The client realized a capital gain of $3,000 in one of the previous three years while they were in a 50% tax bracket. The client sells the security at a loss, offsets the gain from one of the previous three years, and will be able to obtain a tax refund of approximately $750 (3,000 X 50% X 50%). However, the client does not want to “fix” this loss. They purchase another investment that will not be considered identical for $7,750 ($7,000 from the proceeds of the investment sale + $750 from their personal savings to be repaid from the refund of their next tax return). If this second investment regains its original unit value in 2027, the FMV of the second investment will now be $11,071. Upon selling the second investment, the client will realize a capital gain of $3,321 instead of the $3,000 that they would have received if they hadn’t reinvested the tax savings. The capital gain realized on the second transaction would have been $0, and the strategy would not have generated tax alpha.

Scenario 2: Take advantage of different tax brackets

This scenario may even provide a better return if there’s a difference in the client’s tax rate between the time when the initial and final capital gains were realized.

Over a five-year holding period, tax alpha can increase up to 143 basis points.* However, the reverse is possible. If an initial capital gain is realized at a low rate while the second transaction is realized at a higher rate, this transaction may generate negative tax alpha. In some cases, this difference may decrease as low as 56 basis points.* It depends on the differential in the tax rate between the time of the initial transaction and the final transaction. On average, this gain will be 44 basis points.* It’s important, therefore, to know your client’s marginal effective tax rate.

Recall list

If you want to put this type of strategy in place, you must know the client’s tax situation. Here are some questions to discuss with them:

- Will the Superficial Rules be triggered?

To learn more, click here.

- Did the client realize any capital gain in the previous three years?

- Will they be able to reinvest their tax savings?

- What were their tax rates?

- At the time of the initial transaction?

- At the time of the final transaction?

Ultimately, these tax rates will affect the tax alpha generated by this transaction.

*Calculations made by Sun Life Global Investments Tax and Estate planning team, based on traditional tax tables, based on tax brackets applicable in Quebec in 2023. Comparisons based on eight tax brackets (64 scenarios), upon purchase of the title and at its disposal five years later.

This content is provided for information purposes only and is not intended to provide specific individual financial, investment, tax, accounting or legal advice and should not be relied upon in that regard and does not constitute a specific offer to buy and/or sell securities. Information contained in this document has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

Case studies presented are hypothetical in nature and are not intended to be representative of actual client scenarios. Each client will have individual personal income or tax situations that may have additional complexities outside the scope of materials discussed in this document. Investors should seek professional investment advice and/or the advice of a tax advisor for a comprehensive review of their personal situation prior to implementing any investment strategy.